Sweet Baby Crude Oil Update

For those who watch the oil and energies market, crude oil has been bouncing around and due for a chart update. We got some big supply news today. Came in way higher than expected. The oil market absorbed the supply and we didn’t see a massive drop…The last update here is what I had to say:

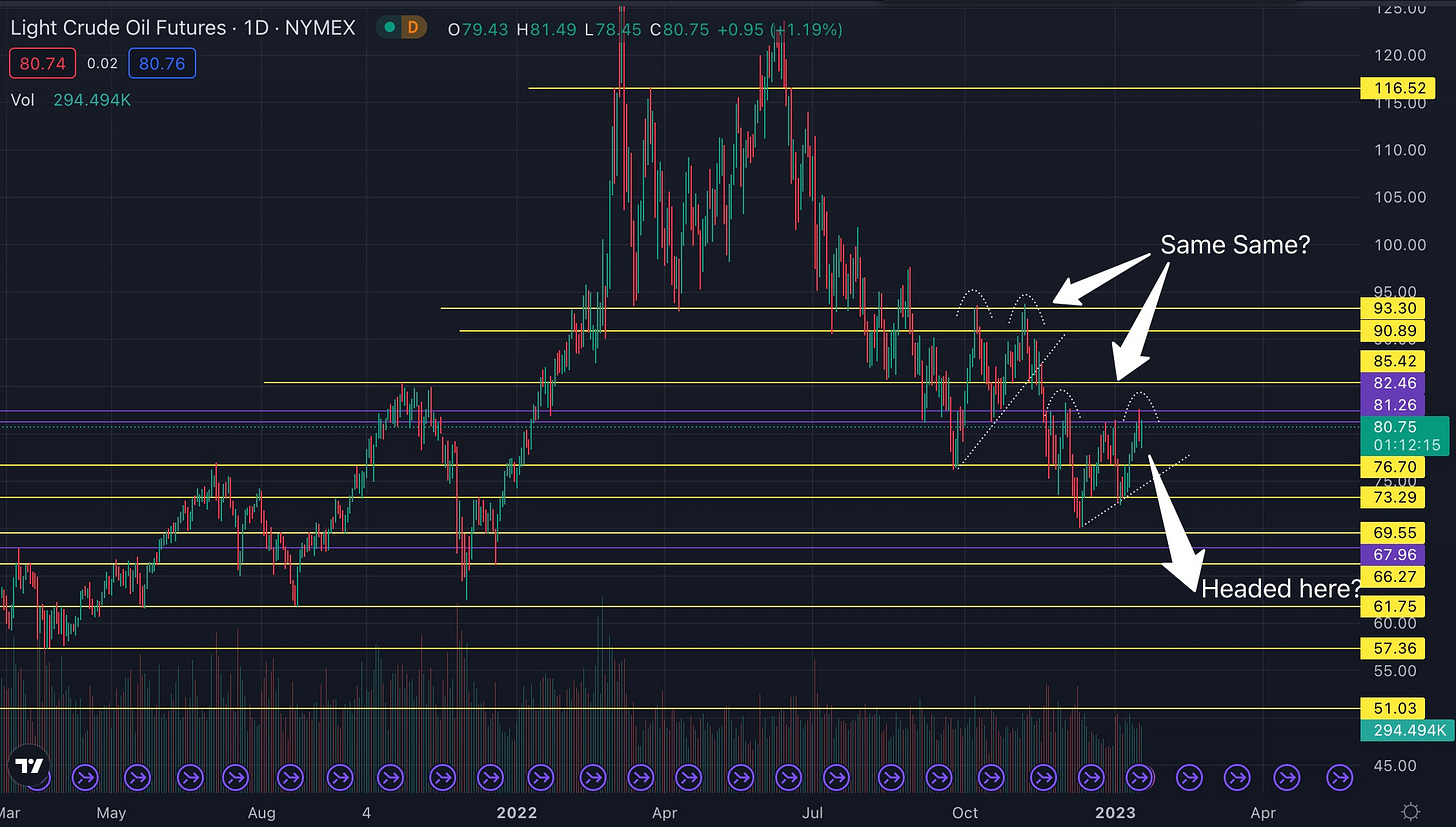

Since then, 70 has held up. We are making a small series of higher highs and higher lows and have somewhat of a rising trend line. But we also have this ugly semi double top formation. The setup looks quite similar to back in October-November ‘22 time frame when we got a double top with a rising trend line failure. Will this repeat? A little too early to tell…However…

There is a TON of supply/resistance at the 80-81 levels. If price rejects hard, we could easily come down and head for 61-62. Another option is price breaks over the 80 area and chops between 80-90.

Still a little early for an answer so I would be hesitant to take any oil/gas equity plays right now. Tickers such as $CVX, $VLO, XOM 0.00%↑ are all showing signs of topping. If Crude starts to head south with all of these topping patterns, could make for some good puts plays.

My chart with levels below on those tickers: