TLDR: Friday Watchlist at the bottom of the post

First some Twitter Ticker Requests:

I don’t love AMD here. Like the theme of this newsletter, sitting in no man’s land. I want to see if AMD makes a decision to clear 89-90 or come back and test 84 and hold. Above 90, there is chop above. Ideally, it needs to get above 95 to make things cleaner. If 84 fails, 80 could come in a weak market.

Backtest Trade Idea: 203+ holds 207.5 calls

Boeing still has a bull flag formed up. As I drew it last week, it was more of a pennant. We took the trade on a breakout of the pennant and it worked awesome. Since then, however, it has pulled back into the flag. It’s not perfect, but it does look more like a flag with the lower bound being 203ish and upper bound being 215ish.

If the broader market is holding up and/or BA is showing relative strength to the DOW and blue chips, a backtest trade is worth a shot if 203 plus can hold. If 203 fails, that would be a break of the flag and more negative. I would put my stop just under 203 to give you some wiggle room to not get shaken out.

Trade Idea: 250p<255.5

Microsoft’s major run up since their ER looks to be coming to an end. It has a not-so-perfect double top and a gap below. I don’t like any trades to the upside in this area. There is a fair amount of chop and supply in the 262-268ish range. If it does go higher, I want to see how it gets thru this area before taking a long trade.

On the short side, the gap below 257 could easily fill with tech or market weakness. I don’t want to enter here. Gap plays are all too common and I expect buyers to step in at the gap fill around 255-256. I want to wait to see if the gap fails. Further, I want to see plenty of tech weakness AND relative weakness on MSFT before taking this trade. If 255 fails, it could be good for 4-5 points down to 250-251.

Pinterest attempted a breakout this past Thursday but failed hard. Is this a false breakout? Looks like it may be. With this rising wedge and the failed breakout, looks like PINS could be heading lower. It’s a little early to tell, aka in no man’s land. I would like to see how price responds around 26+ and, if that fails, the bottom end of the wedge at 24-25.

For the upside, it really needs to get back out of this wedge and over last week’s high at 29+. Until that happens, I don’t love any long trades. Even a backtest trade off 26.5ish is going into some chop…not ideal.

PINS is typically a slow mover so longer dated options or common stock may work better entering long or short.

Onto Today’s Programming:

What to expect in the broader market and #ES E-Mini Futures:

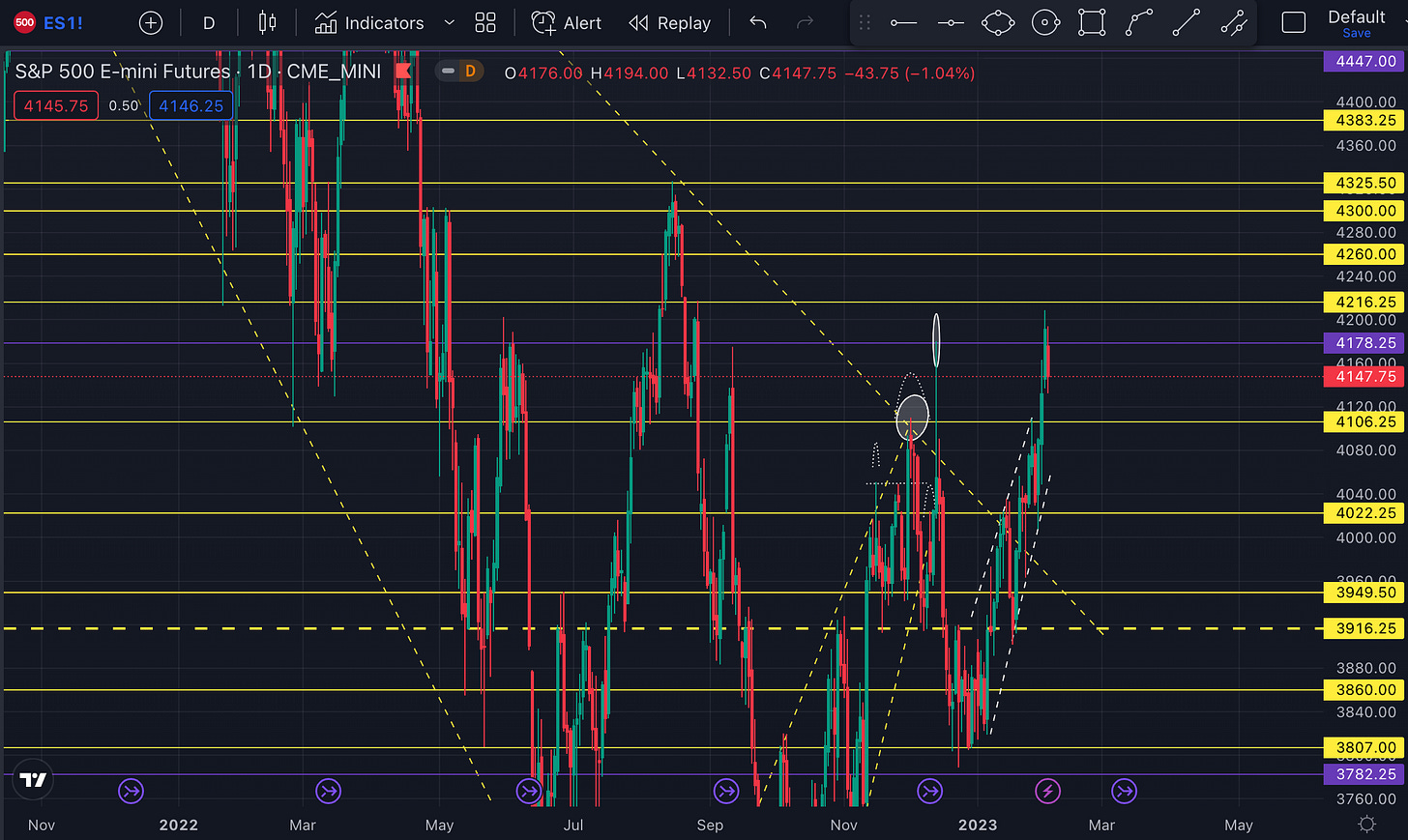

Upside: **4180**,4215, 4260, 4300

Downside: 4110,4080, 4050, 4020*, 4000,3980-3975, 3950, 3915*

In last Friday’s Newsletter, What Will the Ugly Big Tech Earnings Bring?, I mentioned the possible double topish looking thing we have around 4180. At the time, I didn’t totally agree given we broke above 4200 with some strength and closed the day over 4180.

Well, we got this red inside bar on Friday and things are looking more negative heading into Monday. I’m still not sold on the double top argument. We could be