TLDR

Trades for the Tomorrow and the Week Ahead:

News Events for the Week (from Forex Factory):

We have a bunch of Fed Speakers off and on all week. Shouldn’t be too exciting but you never know. The biggies to watch are Core PPI, Retail sales, and Unemployment. These will add on to last week's data for the Fed to confirm (or not) they are on the right path (in their own mind) in the inflation fight.

Earnings for the week (from Earnings Whisper):

NFLX 0.00%↑ first big tech name to report. More Financials reports. No major market movers. If you are into financials and XLF 0.00%↑ keep an eye on some of these names. I’m avoiding NFLX this week since option’s premiums will be elevated due to earnings.

#ES_H $SPX

E-Mini (ESH1) Futures Chart Link

Upside: 4020*, 4050, 4080, 4110, 4180*

Downside: 3975, 3950, 3915*, 3860, 3820

What everyone and their dog, grandma, and neighbors best friend’s cousin is watching. Below is the weekly chart. I’m going to argue we are ready to break higher for the following reasons:

Put in higher lows and had a retest of the trend line following the higher low

The trend line tests happening closer in sucession

More volume on tests

Not getting hard rejections

And below the Daily Chart:

Remember, trend line/level tests are like throwing a ball against a wall. More times you throw the ball and the harder you throw, the more likely the wall will break. Notice how on previous tests, we test, come back down, form a lower high, then drop. That has not happened this time. Further, there’s positive bottoming/consolidation going on.

And the comparable SPY 0.00%↑ levels:

Upside: 399*, 403, 407, 411*

Downside: 390*,387,383*, 378

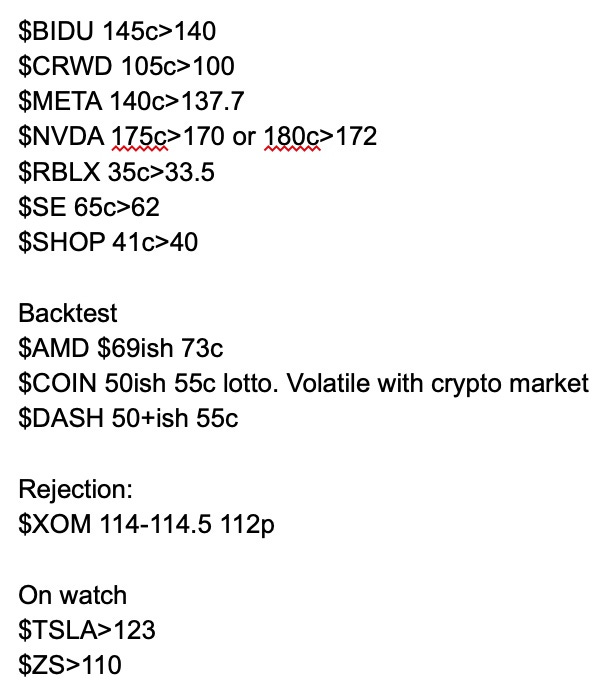

Upside: 285*, 293, 297*

Downside: 275*, 270*, 266

Tech has been looking good and we may get some rotation back into more risk and growth this week if everything keeps looking positive. It’s right above 280-281 resistance and looking ready to test the major trend line from all time highs. I’m a little leery of the downward trend line on the nasdaq vs sp500. If QQQ tests 285, will that cause a breakout on S&P500 to fail? Too early to tell.

Upside: 135*, 137-138, 140, 143

Downside: 132, 130-129, 127-126

Trade Idea: 137c>135

Just in the beginnings of a bottoming formation. Apple could keep heading up without a major pullback…which could pull the whole market up or visa versa. The 135-138 area is the only thing I see as an easy upward area for right now. Once at 138, could get a bit tougher to get thru without a pullback.

Trade Idea: Backtest off support around 69 take 73c

AMD looks ready for a longer term trend shift. For us day traders, how do we take advantage of that? Well, we follow the trend and look for pullback entries or breakouts within that trend. For this week, if we get a pullback to 69ish (nice), I’ll look at dipping in to a trade. If it heads straight to 73, I may wait and give it some more time to setup and see how it handles the 71-76 area.

Upside: 101-102*, 106

Downside: 98*,92*, 90-88

Trade Idea: Rejection 102ish if market weak

I don’t love Amazon here. I would like to see a bit more construction around the 98-102 area. There’s a bunch of resistance coming up right over 100. More time is needed to see how it handles this resistance zone. If it clears with momentum it should be a non issue and 106 area should come quick. But more likely, we see some stalling in that area.

Trade Idea: 145c>139.03

Like the rest of the major Chinese stocks, BIDU has been ripping since China’s Covid lockdowns eased. BIDU keeps blasting thru resistance levels with very little pause. It still has room to run even though it’s doubled in a few months

Trade Idea: 105c>100

Bottom? Yes? No? Maybe? Who knows… but I like this trend line break. If it can show strength over 100, there’s room to gap fill up to 102.5 (which would make a nice trade for about 75-80% profit). Clearing 102-103, in a strong tech market, could easily see 110. But, if is slow to clear 100, or if the market is generally slow, I would be more hesitant taking this trade.

Trade Idea: 50.5ish backtest 55c

DASH has shown signs of bottoming and staying above the 48-50 area of support. I like this more for a backtest/support type trade. If the backtest doesn’t come, I feel there is too much overhead resistance in the 53-55 area to make a breakout trade work. Once in that area, it will need some time to see how it develops and shakes out of that supply/resistance zone.

Trade Idea: 140c>137.7

Facebook…I mean META has been on a tear since breaking out of the bull flag triangle. Very textbook. Looking good and I think there is a lot of room to run if it clears the 137-138 area. Not much overhead supply and we could easily 160 in time with a strong market. Short term this week, if the market is strong, 150 could be in the cards. BUT, if the market reverses and/or 137-138 rejects hard, META could come back down to test 122-125 area. Watch getting shaken out of this one if you go long at 137-138. It could very easily bounce around at 137-138, pullback a bit and shake people out, then rocket off to 145-150. I will most likely size the trade fairly big but be willing to watch the trade lose a bunch and/or make the entry small enough that I can add on a small pullback.

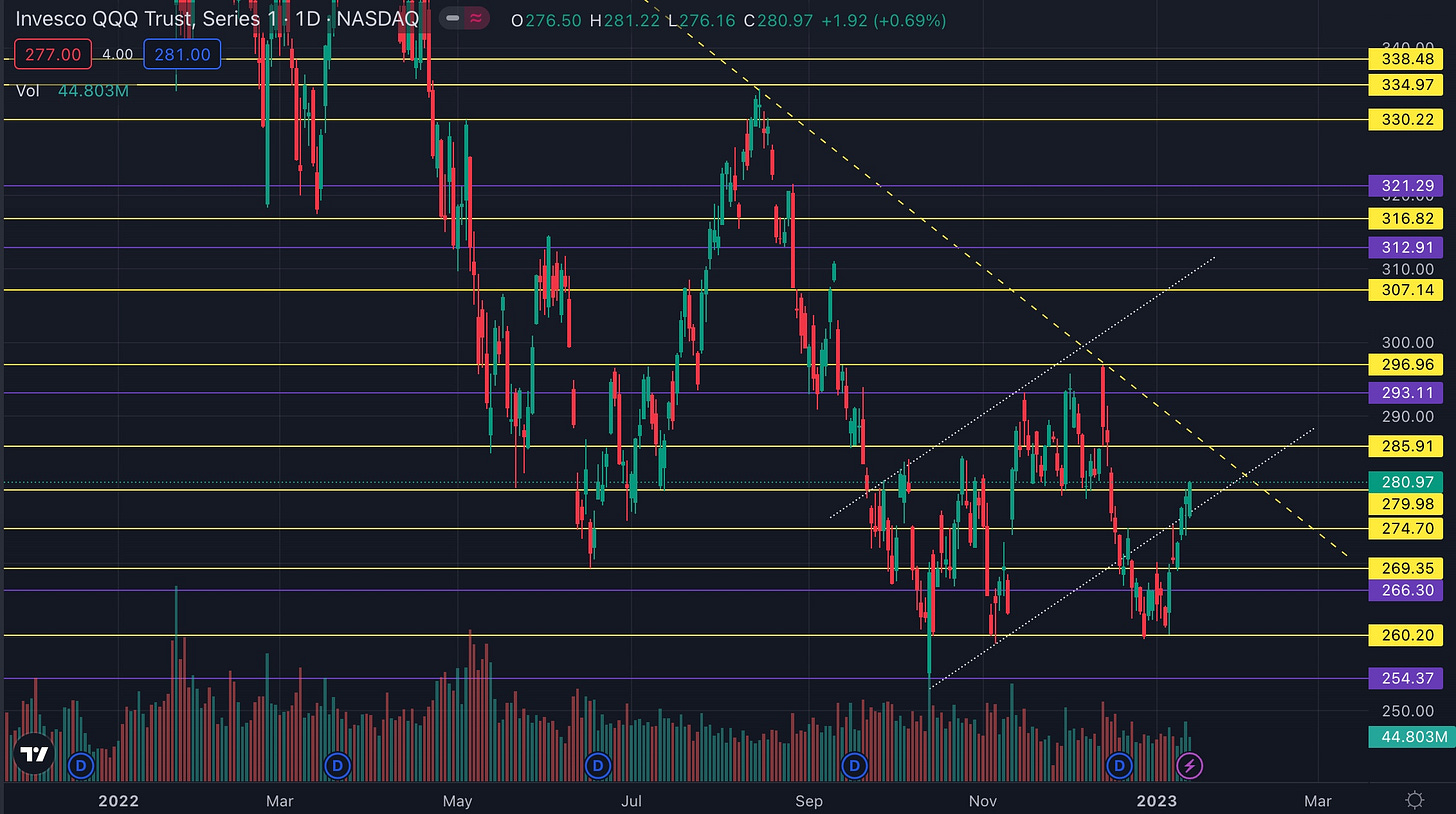

Trade Idea: 175c>170 or 180c>172

Coming out of a somewhat cup n handle pattern. Purists will probably say the formation is invalid due to the handle going to deep into the cup…blah blah..blah. Whatever don't care, just watch the price action and support/resistance levels. Lots of support/resistance in the current area 160-170. A breakout over 170 might be a bit early and more risky, but worth a shot. The 172 break is a little cleaner. I will take over 170 if the market is strong tomorrow or Wednesday.

Trade Idea: 35c>33.5

Another growth name coming off the bottom. We still haven’t seen any sort of meaningful pull back to the 30 area. Not saying that happens, however, if it doesn’t clear 33.5 area cleanly, going back down to 30 may happen. Especially, if growth names, or the broader tech market shows weakness.

Trade Idea: 41c>40

Is Shopify finally going to breakout of this mega base? Looks like its heading that way. 40 is a big resistance level. Could easily fail. I would take a smaller position over 40…but definitely worth a shot. Clearing 42ish this week, should see 45 relatively quick.

On Watch over 123

Tesla is a wild card for me. I’m most likely just going to keep an eye on 123 and see how its handled. May be ok for a quick scalp if the tech market shows strength. Overall, I would like to give it more time to form up and see how this dashed upward trend line is handled. If it breaks the trend line with downward momentum, we could see it head back towards 110-114. Just not real clear yet.

On watch for rejection at 114.5ish. Could take the 112p if the Oil/Energy Markets look weak. Possible long breakout trade over 114.5 if oil really pops this weak (I kinda doubt it)

Just slow rising wedge…nothing too exciting but 114-114.5 is major resistance. Small shot with some puts if price shows signs of running out of steam at those levels.

On Watch over 110

Looking interesting with this falling wedge breaking and small bottoming formation. I want to see it get up to and over 110 with some volume and momentum. This ticker is usually a cheap option premium, so when it does have the big pops, the options can easily pay 3-5x.