TLDR Watchlist for Thursday:

First up, let’s take a look at today’s watchlist results:

Today was really tough for the upside. Even though we showed good movement and a few tests to break higher and stay above 4020 on #ES, nothing could get going and everything sold off. When premiums don’t pick up for the correct direction that is often a sign a reversal could be in the works. Wrong while being right. It’s a tough pill to swallow. But it’s our jobs as traders to pick up the little breadcrumbs the market drops. Lack of premium gain was one of those breadcrumbs.

#ES Futures, $SPX and $SPY:

Upside: 4020*, 4050, 4080, 4110, 4180*

Downside: 3975, 3950, 3915*, 3860, 3810, 3775*

Yesterday I wrote about the not so good looking candle we created yesterday. Today we got negative follow thru on that bad candle. The momentum has shifted downwards. I would’t be surprised with another red day tomorrow based on how the previous rejections off the trendline have gone as well as the red candles.

What does the rejection mean? So far, not much. We need more time to see what happens. If we hold over the 3810, I will still be long term bullish and think we go higher. Below that 3788, is the last stop before I switch to neutral or bearish. Everyone is watching the big downward trend line. The more important and more eyes on something, that harder it is to move in one direction or the other. Whether you’re a day trader, swing trader, scalper, whatever, it’s important to check your bias.

SPY -1.91%↓ for comparison:

Upside: 399*, 403, 407, 411*

Downside: 390*,387,383*, 378, 374*,370

Upside: 285*, 293, 297*

Downside: 275*, 270*, 266, 260*

Backtest Trade Idea: 275+holds 277 calls

Something interesting going on between tech and the broader market…We are bit off timing wise. What I mean by that, Nasdaq has been technically a bit cleaner that $SPX. Yesterday was a pretty textbook rejection of the long term downward trend line and we got follow thru today. On the S&P, it wasn’t very clean…we broke above, failed, tried again, failed, etc. If Nasdaq and the S&P500 can line up better, we should see better movement and direction. Both indices breaking over their long term trendlines at the same time with momentum will be the key to long term movement upwards. If and when that happens, I will size in heavy.

QQQ has come down to that bottom of the parallel channel support. Could be a good spot for it to hold up. Another option, is a false breakdown, goes to 275ish, holds, and comes back into the parallel channel.

For the 275 backtest trade, it’s a pretty simple idea. Just catch the bounce off major support and see what happens. I wouldn’t be too picky on my entry and just make sure to size the trade knowing it could go to zero.

TRADES FOR TOMORROW:

Backtest Trade Idea: 134-134.5 holds, take 136 calls

If we get more downside tomorrow, watch for Apple to hold the 134-134.5 area. I would be tight with a stop. You can always re enter. Watch to see how $AAPL, $AMZN, and some of the other big tech names perform at the open and into mid day for a better idea of where the market is headed.

Rejection Trade Idea: 103.7+ rejection take 102p

Exact same idea as written for yesterdays trade idea…which worked out really well:

“ABNB is coming up to a good sized resistance zone after a big run up. This is a bit of a risky trade since the market and this ticker have shown momentum. I would only take this trade if the market shows weakness or signs of reversing at the time it hits the resistance zone.”

Backtest Trade Idea: 69+ holds take 71c

Similar idea to $AAPL, looking to get in on a backtest/bounce. 69 (nice) is decent support. Two options for stops:

1.) Keep the stop tight right below 69. Just be ready to possibly re enter or know you could get shaken out or

2.) You could size this small and let it fall to 67 and add there as another support zone if the trade still looks valid.

I like option 1 better, but you have to be emotionally ready for that type of trade. It takes a bit more metal willpower to go thru a trade like that.

Assuming price gets thru 70 ok, there should be plenty of room to get to 72.5-73. Which would make for a great trade. Even hitting 70 should give 40-50% profit depending on entry.

On Watch: 54ish support or over 57.5

Ugly candle today so maybe heading for a reversal. I’m just putting this one on watch for now. I would like to see how it handles the 54-54.5 area on a pullback. If it rockets higher and gets up and over 57.5, that will make me much more bullish on this name.

On Watch over 137.7

Just on watch due to the weakness today. If it gets up to 138 area tomorrow that would be a pretty massive 1 day move. Unless the broader market shows signs of a huge squeeze or ramp, I’m more inclined to hold off until Friday even it it does get up to that area.

Part of what I wrote on Monday: “BUT, if the market reverses and/or 137-138 rejects hard, META could come back down to test 122-125 area.” Another reason to hold off until we get clearer market direction.

Backtest Trade Idea: 170+ holds 175c

NVDA had quite the run up since New Year’s. Not a bad place for a small pullback. If the strength is truly there, 170 should hold up. If we get down there tomorrow, could be a good bounce spot. There is some minor support in the 171.5ish range, so it may not get all the way down to 170. I’m ok missing out on the trade if it doesn’t reach my pullback level. I don’t want to jump in early at 171 and then watch it keep going down another 1-2 points.

Trade Idea: 88p<90 (or as low as 89.36)

Chinese stocks did not fair well today. The beginnings of a pullback on some of these huge runs up could be in order. PDD options are still really cheap. Or put another way, a small move can make a trade work and yield big gains if it runs in our direction. The 90 level is good support with another minor support level around 88-88.5. However, even a 1 point move should give 40-50% on the trade. Well worth giving a shot.

Backtest Trade Idea: 70.5+ish holds take 72 calls

SQ came right up to a major support level at 76 and failed today. It’s failed at that level numerous times over the past 6 months. Once it does break over 76, we should see a pretty strong move. Until then, taking a backtest trade around 70.5ish is worth a shot. Pretty strong support level. If 70+ doesn’t hold up and continues to drive lower, most likely, there are bigger underlying problems with the market and you would probably exit anyway. But, if you need more of a solid stop number, use 70 but be aware you may get shaken out. I like the idea of using no stop on this one and just letting the trade go to zero if it doesn’t work out.

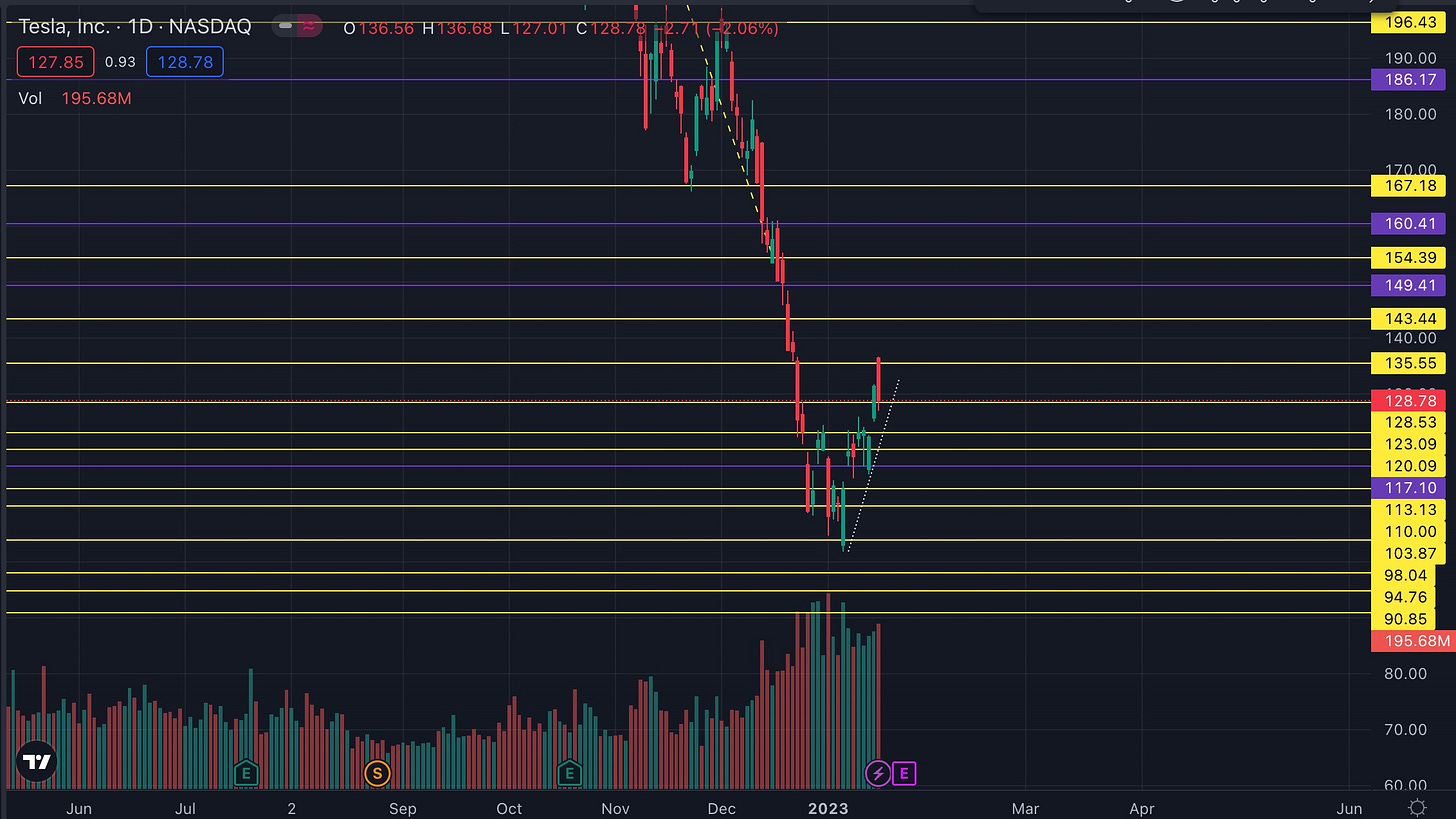

Trade idea: 125p<128 (can also take under 127)

Tesla gave a big ugly reversal today and came right down to close at 128 support. I like a short trade for a continuation of this move. If the 127-128 area fails, 123 could easily come. Surprisingly, the option’s premiums aren’t very expensive. That is the main reason for even looking at this trade. If the premiums were elevated, it wouldn’t be worth taking. For this trade to work, we will only need 1.5-2 point move to yield 40-50% profits. Well worth it.

Open Trades:

SHOP 41 calls: Entry price $0.43 still holding 1/4 of the positions. Exited 3/4 of it today for 56%