TLDR Tuesday Watchlist at the very bottom of the newsletter.

The watchlist for tomorrow is very unexciting. Reason being is we are seeing our first reversal after the big run up. Many stocks are in no-man’s land after the drop we saw today. We are not quite at the point where we need to switch to more of a temporary short bias. The market needs time for some stocks to setup for trades in one direction or the other.

Today’s Watchlist Results

We only had 1 trigger with CRM 0.00%↑ getting ok gains for the slow market. It’s important to not chase and to not go in early in slow markets. I still expect more slowness tomorrow. The market waits on AMD 0.00%↑ earnings and big oil tomorrow, as well as FOMC on Wednesday.

I’m going to keep watching for intraday or quick type trades if nothing looks like it will trigger. Most likely, we see more slowness tomorrow at the open and throughout the day. On the 0dte options, I like to trade SPY 0.00%↑ or QQQ 0.00%↑ the first half of the day and then move to $SPX once some time premium gets pulled out.

How to choose SPY 0.00%↑ vs QQQ 0.00%↑ ?

Simply, I usually take which ever is showing more strength if I’m going long or whichever is showing more weakness if going short.

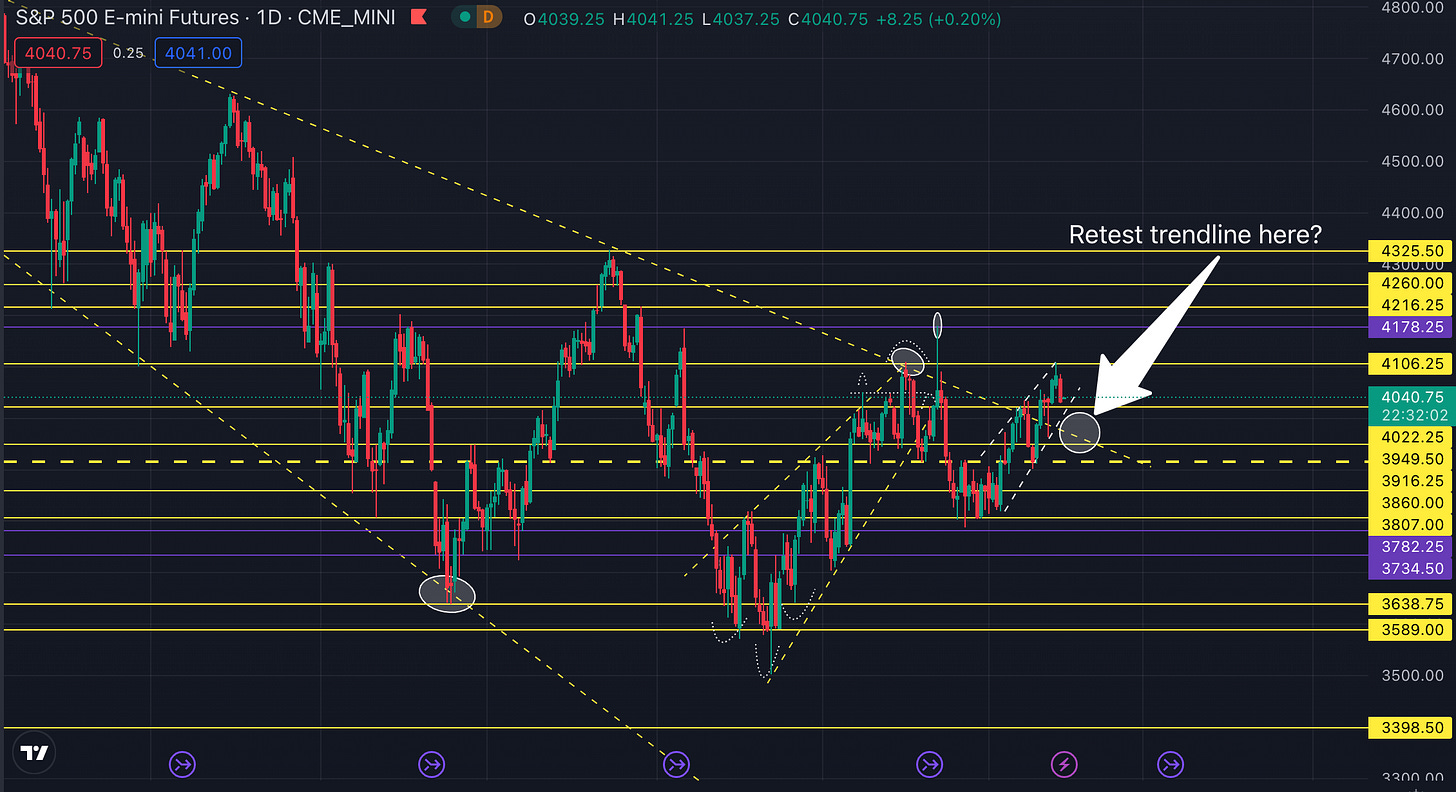

#ES E-Mini Futures

Upside: 4050, 4080, 4110, **4180**,4215, 4260

Downside: 4020*, 4000,3980-3975, 3950, 3915*, 3860, 3810, 3775*

Today was rather unexciting but we did get a good sized pullback. After the run the past two weeks, we were due for a bit of a pullback. On the weekend newsletter, I mentioned that it would not surprise me if we get a retest of the major downward trend line. I also said it would not surprise me if we see a 4180 test. Looks like we are setting up for the former. Tomorrow and Wednesday, we should get a better idea if the trend line test is going to happen. Overall, the market feels very torn…1/2 think we crash lower, 1/2 think we rip higher. Regardless of what boat you’re in, trade the price action in front of you. Plenty of money will be made after we work thru this week’s news and earnings no matter the direction.

For tomorrow, I want to see 4020 hold up. If we lose this little rising parallel channel that’s formed, it becomes more likely the trend line test comes sooner rather than later.

On the upside, 4080ish area continues to be tough to get thru. We got within 2 points of 4080 today, reversed, and never came back up to test. I’d imagine, if weakness is present over the next two days, 4080 will be the benchmark of breaking higher.

SPY 0.00%↑

Upside: 403, 407, 411*, 417, 420

Downside: 400-399*, 397, 393, 390*,387*,383*, 378, 374*

SPY is looking a bit worse than the E-mini. I don’t love how it’s more of a rising wedge vs a parrellel channel on ES. Further, SPY looks ready to break lower. 399-400, needs to hold tomorrow or we get closer and closer to testing the downward trend line. If things get bad, 397 will come into play right around the downtrend line.

For trades, if the market is slow, trying for a support/backtest type trade off 399-400 as