TLDR Monday Trigger list:

Earnings coming up this week (Courtesy of @eWhispers)

We’ve got a few biggies this week. MSFT 0.00%↑ on Tuesday then TSLA 0.00%↑ BA 0.00%↑ on Thursday. Other ones that could help move the markets are $INTL, $IBM, and in financials $MA, $V. Oil Stocks VLO 0.00%↑ and CVX 0.00%↑. There’s enough big earnings in both tech and blue chips to move the markets if ER come in positive or negative so we may see both gap up and gap downs if that happens.

New Events:

PMI and price index news could help move as well as Income and Spending. Nothing major, but again, if we combine all the news plus earnings could be a good catalyst.

If you like energy, watch the oil inventories and stocks like $CVX, $VLO, $XOM. All 3 are setup near highs at big resistance. See below for more details.

#ES E-Mini Futures

Upside: 4000, 4020*, 4050, 4080, 4110, 4180*

Downside: 3980-3975, 3950, 3915*, 3860, 3810, 3775*

Let’s start with the all important downward trendline that’s developed since the all time highs. Yes, we are all watching it. If you are even the faintest of a technical trader, you are watching this. If you’re not, well, pay attention.

Last week was a pretty major deal in, my opinion. First, we break over the trendline and fail. Next, we saw a major pullback and very important support levels held up. Plus, we got a major bounce off the lows of the week on Friday.

3915 has become a support/resistance battle ground the last few months. With 3915 holding, pullbacks getting shallower, trendline tests getting more frequent, in this dumb dumb’s opinion, it’s not a matter of if, but when we finally breakout over this trendline. That’s my bias. Unless the Fed or some other crazy news happens, I’m shifting more bullish.

Watch 4000 and 4020-30 area. It will tell us a lot how things start to act. If we are chilling and just grinding up to those levels, we may not get the pop we are hoping for. However, if major players and momentum step in blasting us over 4020-30, I would expect a major multi day rally to ensue.

I know there are a bunch of doomsayers out there expecting a crash down to 2500 or wherever. Maybe that happens, maybe it doesn’t. As day traders, frankly, we don’t care. We trade what’s in front of us. But Dino, you just said you’re bullish?

Yes I am. But who knows. Maybe we blast thru 4035 and then at 4100 we get rejected hard and fall right back under the trendline. I would most likely shift to neutral (expecting chop) or bearish, if that were to occur).

SPY 0.00%↑

Upside: 397, 399*, 403, 407, 411*

Downside: 393, 390*,387*,383*, 378, 374*,370

SPY is more or less telling the same story. Watch 397ish then 399-400 for response. If you trade $SPY, the levels aren’t quite as clean as the E-Mini futures. In other words, know your grey areas and how to trade into and out of the grey areas.

QQQ 0.00%↑

Upside: 285*, 288-290, 293, 297*

Downside: 275*, 270*, 266, 260*, 279-280

Last week I mentioned how the S&P500 and the NASDAQ just aren’t quite ready to commit to each other. Think Ross and Rachel, just not quite in sync and ready for each other. Yea I know I’m dating myself.

But...how quickly things change. If the markets rally this week, we should see everything breaking out at a similar time. Meaning #ES clears 4000 then 4020-30 area at the same time $QQQ is clearing 285 then 288-290. If all of that happens on the same day or over the course of multiple days, I think that is a driving catalyst for a major run.

If a major run does start in one or all the markets, be prepared. Know what you want to trade ahead of time. Stick to what you know. And don’t jump in random trades with fomo.

Alright moving on to the tickers. A lot on the list due to many stocks looking like they’re ready for major moves. Don’t get overwhelmed. Pick what you like.

AAPL 0.00%↑

Trade Idea: 140c>138

On strength:145c>140

On a pullback: 135 holds 138c

Apple is a proxy for the broader market. Notice how AAPL held and got back over important levels at 130 and 135. At the same time, $SPX also held its important levels? Coincidence? I think nope.

For this week, I’m watching how it gets over 138 and the reaction at 140. If it opens over 138 on Monday, I’ll wait to jump in to a trade until I see direction at 140. If we get a pullback at some point this week, I’ll look to go long off 135 assuming the broader market cooperates.

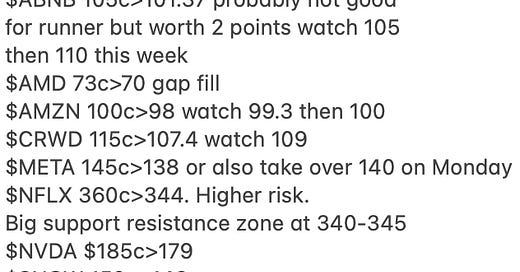

ABNB 0.00%↑

Trade idea: 105c>101.37

On strength over 105: 110c>105

AirBNB has been in a tear and pretty much been vertical since the start of the year. It broke thru that downward trendline with lots of strength and has been running ever since. I think we will start to see some resistance and slowness now that it’s hitting some tougher levels. But, I like the trade because options premiums are relatively cheap. A 2 point move could be a 50% gain on an options trade.

I like getting in early over Fridays high and hoping for a run over 104. Even if it stalls out, there’s your 2+ points giving you 50% or so. If it gets thru 104 cleanly, 105 would be the next stop. I would like to see response at 105. If it pulls back and backtests, 103 could be a good entry.

More on the downside, I wouldn’t take this short until more construction happens. Too much support and supply around 100 and down to 97.

Trade Idea: 73c>70

AMD first up of the semis. Semi were very strong on Friday. In AMD’s case, we retested the long downward trend line and hit support around 67 on Friday. The reversal and close near the highs on Friday is huge strength. I like the continued strength over 70. However, if we pull back and go under 70, I would wait for more construction to develop to get a backtest entry and/or go short.

AMZN 0.00%↑

Trade Idea: 100c>98

I was little hesitant with Amazon last two weeks and wrongly so. It came off the bottom and thru that little downward with strength. Now it looks like we have a higher low and a meaningful trend reversal. You could take it early over highs of Friday at 97.35 but I would prefer to wait for 98. There’s a fair amount of resistance all thru 97. Once it starts moving up, watch the response at 99.3 and then 100. Could be good profit taking spots. I wrote up a quick thread on profit taking last week and this could be a good position to use the hybrid profit taking system.

CRWD 0.00%↑

Trade Idea: early 110c>107.4

More conservative: 115c>109

We got a really nice trendline break last week and looks ready to reverse longer term. Last week the 98-102 gap acted like a magnet but on Friday it broke free of that and got over 102-103. Looks primed for a 109 test. If you want to take it early above Friday’s highs at 107.4 that could work. Just be ready to take some profits at 109 area if it reverses. The conservative play would be to wait for 109 to break on momentum and tech to line up with that break.

META 0.00%↑

Trade Idea: 145c>140

If Gap up wait for a 140 or 138 retest.

META is one of the better looking setups over the past few weeks. The ttade was mailed a few times. Friday was a major winner over 250%. The stock still looks good and has room to run.

I’m looking to take a good sized position over 140. If we gap up, I’ll wait to see if we get a 140 backtest. If the market pulls back, I’ll watch the 137-138 area to go long on a retest. There’s plenty of support all the way down to 133-134. If 137-138 fails, I’ll stop out and look to renter long around 134. One of the more clear cut trades this week. Remember, the broader market needs to line up. Don’t just jump in because a level hits.

NFLX 0.00%↑

Trade Idea: 360c>344. Higher risk. Big support resistance zone at 340-345

Netflix ripped last week on their ER. Market liked what they had to say. We got a big gap up and the run held up on Friday. Everything is looking positive so far.

Price wound up in a bit if a supply zone amd at the top of the gap from April 2022. For Monday, it’s a higher risk trade over 344-345. As the week goes on and premiums come down, the risk goes down if price chops in the 340-350 area.

Downside I want to see 333-335 hold up. If we lose that area we most likely fill the earnings gap down to 325 area.

Make sure you know your levels on this one and understand market

NVDA 0.00%↑

Trade Idea: 185c>179

Just absolute strength on Friday. Broke thur a bunch of resistance levels like they’re nothing. There’s a pretty good size supply/resistance area in the 179-182 range. However, the relative strength was huge on Friday. If it breaks over 179 I think we get follow thru over 182. I wouldn’t size this too big as it is in a resistance area but worth a shot for sure.

SNOW 0.00%↑

Trade Idea: 150c>146

Like a lot of tech, Snowflake is showing major bottoming signs and is on verge of breaking over its longer term trendline. The breakout levels aren’t very clean. But, I think if it breaks over the trendline around 146, it could make for a nice run. There’s still a bunch of resistance from 146-150, so I would be careful on sizing unless there just absolute relative strength.

Downside, if 146 fails or we reverse lower you could look at going short below 135. I want to see how the week plays out before committing to that so downside just on watch for now.

SQ 0.00%↑

Trade Idea: 80c>76 can also take over 77

Block was another one of Friday that showed dominate relative strength. Price action has been really strong since breaking out of the triangle and various resistance levels. Price is right at another breakout level and any strength we could easily see another run. The level isn’t super clear cut so if we gap over 76, you could also try over 77.

Be prepared for it to get rejected since it’s strong resistance. If that happens, I’ll most likely stop myself out and try and renter on another break above 76. Another options is to if price comes down to 72.5-73 on a backtest. Worth an entry there only if the broader tech market is strong.

TSLA 0.00%↑

On watch for direction above 135 or below 128

Just on watch for now. We have a rising channel within the longer term falling parallel channel. I would like to see how it handles these channels before taking a trade.

What I mean by that, if price breaks over 135-136, that would be very positive breaking out of the long term channel.

However, if price breaks lower under 127-128, I’ll be in wait more to see if it continues lower or if it chops and finds support for another test out of the longer term trendline.

TSM 0.00%↑

Trade Idea: 94c>91 fairly big resistance

Been on a massive run. TSM has been leading the semis for the past few weeks. Lots of gaps the past two weeks. I’m watching it over 91.

We have $AMD, $NVDA, and $TSM all on the watchlist. I try to avoid taking similar sector trades at the same time. I’ll probably pick the ticker that has the most relative strength out of the 3.

VLO 0.00%↑

On watch at 146 for response

Weaker trade: 145c>142. Take profits as price hits 146.

Reversal Trade: rejection off 146, 140 puts

Valero is breaking over the downward resistance line at 142. A trade over 142 could work up to 146 area. I’m hesistant to take a trade in this 142-146 area so I’ll wait to see how 146+ plays out.

I’ll be watching the crude oil market as well to give better direction on how to trade any of the oil stocks.

XOM 0.00%↑

On watch at 114.5+ for response

If 114 fails, 112 puts

Over 114.5 plus strength in crude, 117 calls

Exact same idea as $VLO. Pushing up to 115 is huge resistance. Crude oil futures market is going to have to pop at the same time Exxon is popping over 114.5-115.

If the oil market shows weakness, could be a good reversal trade if 114 fails.

ZS 0.00%↑

Trade Idea: 122c>119

Backtest trade. 109-110 holds 115 calls

Making major moves after breaking out of the long term falling wedge. Had a major 1st day move and broke over 110 with ease, came back to retest, formed a higher low. Looking like it’s bottomed and ready to head back higher longer term. Over 119 doesn’t need a ton of movement to get a 40-50% trade. If the stock runs over 122, could easily turn into a 2-3x trade.

Downside I want to see 109-110 hold. If the tech market shows strength, I’ll look to go long on a backtest around there with 115 calls