TLDR: Tuesday Watchlist at the bottom

I will most likely be updating the watchlist post CPI release in the morning. I’m guessing a chunk of the list will get voided or be obsolete depending on the post CPI movement.

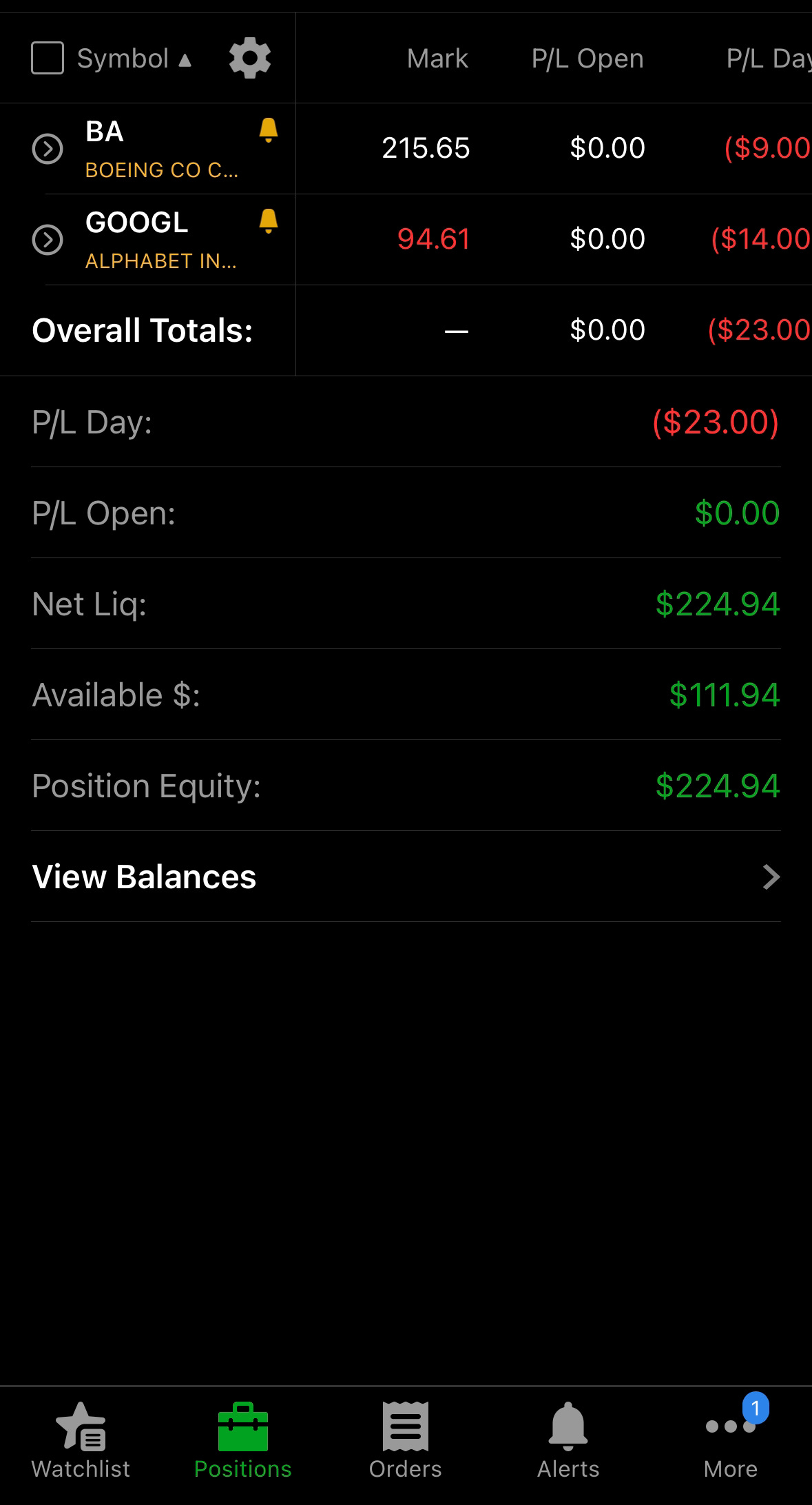

$250 Challenge Account Update:

Check the Discord channel for the latest updates and trade reviews. I made a mistake on the BA 0.00%↑ entry today and instead of a +10% day, the portfolio wound up -10%. Simple error. I sent the limit order with a typo and got a bad market fill.

Monday Watchlist Results:

Today was, well, boring. Not my type of trading day. Real, slow grindy movement. There were a few good reversal/support plays such as AAPL, META, NVDA. Those trades are hard to take with a smaller account. In a normal sized (say 10k) plus, it’s easier to make the risk tolerance work.

For tomorrow, we have the big news release of CPI (all times Eastern US). Some people are making noise about the way it’s measured. Further, plenty of economic furus are complaining about the adjustments and the market not reacting appropriately. THE MARKET IS NEVER WRONG!

Make that a mantra. Whatever your bias. Whatever “should” happen. It doesn’t matter. The market tells you what is happening, not the other way around.

Be ready for some fireworks pre-market. There is enough time between the CPI release and the opening bell for a good understanding of where the market may head during the day.

#ES_F E-Mini Futures

Upside: **4180**,4215, 4260, 4300

Downside: *4100-4125*,4080, 4050, 4020*, 4000,3980-3975, 3950, 3915*

For a slow, grinding market, everything was positive. The all important level at 4100-4125 held up throughout the day. We only saw one small backtest of the 4125 area and it held and continued higher to test 4150. This action sets up nicely for a big gap if CPI numbers comply. There is somewhat of a bull flag/falling channel consolidating well from 4100-4180.

To the downside, the dashed rising trend line is what I’m watching. A gap below that is no bueno and we may be in for some downside pain towards 4000. One possibility if we do get a gap down, at the opening bell, we get a pop up to test the upward trend line. Lots of scenarios to think about for tomorrow such as: