We had a major week in the equities market this past week. We are going into the heart of earning’s season and have FOMC on Wednesday. Last week’s move will be tested with all the news. Just a question if support levels hold up.

TLDR Trigger List:

First up, News Events:

The biggy is FOMC. But also watch consumer confidence, job openings, PMI, and unemployment. These are all major fundamental indicators for the Fed and broader economy. How will the equity markets respond? We have to wait and see. If we wind up getting a bigger rate hike from JPow, (expected 0.25%, high would be 0.50% hike), equity markets could see major pull backs. With the big run up from this past week, S&P500 and the NASDAQ have room to fall and land on some good support levels to eventually continue higher.

Earnings Reports for the Week:

AAPL 0.00%↑ AMD 0.00%↑ AMZN 0.00%↑ GOOGL 0.00%↑ META 0.00%↑ MCD 0.00%↑ all reporting this week. When it will get intersting is if we see a bigger hike than expected from the FED but also get neutral or negative earnings reports. In other words, the Fed needs to hike more to cool things off, yet, big companies are showing negative ER meaning they have already cooled off. It will create a push/pull within the equities markets and price discovery will just have to play out.

Many big tickers like AAPL,AMZN, META etc aren’t in today’s newsletter. The reason being are the high options premiums due to elevated implied volatility with upcoming earnings reports.

Know what you’re trading. If you take one of these tickers on an options trade, it’s going to take a lot more movement on the underlying stock to make good profit on the option trade.

#ES E-Mini Futures

Upside: 4110, **4180**,4215, 4260

Downside: 4080, 4050, 4020*, 4000,3980-3975, 3950, 3915*, 3860, 3810, 3775*

As just mentioned, what does the fundamental economic news bring for the chart below? I would not be surprised to see a drop down to 4000 level and give the major downtrend line a retest. BUT, I also wouldn’t be surprised if we bust thru 4180 and continue higher.

I’m shifting to more of a neutral, wait and see mode for the start of this week. After the big run up and with news coming, things feel more uncertain compared to the past week or two. My long term bias is still higher, however, I’m willing to reverse that if we see massive downward momentum this week.

Upside: 407, 411*, 417, 420

Downside: 403, 400-399*, 397, 393, 390*,387*,383*, 378, 374*

SPY more or less moving in lockset with E-mini futures. Watch 399-400 on the downside for the downtrend line retest. Upside watch 407-408.

QQQ 0.00%↑

Upside: 297*, 302, 307, 310

Downside: 293, 290, 288,285*, 275*, 270*, 266, 260*, 279-280

Trade Idea: 299c>297

A few weeks ago, I mentioned how the NASDAQ (QQQ) was not quite lined up with the S&P500. But over the past week or so, that has changed. Part of the reason things were so positive and upward the past two weeks is due to the two major indices coming together. If we start getting more divergence and the QQQ drops more and/or moves away from $SPX, that would give me more of a negative bias.

On the flip side, if big tech leads the market higher on strong relative strength, we could see the broader markets get pulled up the NASDAQ. Lastly, if we do get a push/pull scenario, maybe we chop sideways this week. Be prepared for all possible scenarios.

CRM 0.00%↑

Trade Idea: 170c>165

Salesforce has been on a tear since coming off the bottom. Off the bottom, it created higher highs and higher lows while breaking over the dashed downward trend line. All very positive stuff. It hasn’t seen much of a pullback and 165 is a big level. I like this one if 165 can hold with the broader market holding up or going higher.

CRWD 0.00%↑

On Watch >109

Crowdstrike has been basing quite nicely off the bottom. Its tested 109 a few times lately and failed every time. If the timing does work out with the broader markets pulling higher at the same time CRWD breaking over 109, it could see a nice run.

For early in the week, I don’t like taking this trade early before the 109 break. 1-2 point move won’t give you enough profit on an options trade to make it worth the risk. If it stays below 109 towards the middle/end of the week, that may change and a move over around 107 could also work.

It’s only on watch due to the size of the move needed tomorrow to make a trade work. Going from 104.35 to 111ish is a big ask for a single day. CRWD is capable of making such a move, but it’s a smaller probability trade. Ideally, CRWD moves up to 107 area before we get a 109 test for a higher probability trade.

DIS 0.00%↑

Backtest Trade Idea: 109 holds take 112c

Disney has been on a growth stock type run since the bottom and news of Bob Iger taking back over as the CEO. I’m always hestitant with slow movers that have made massive moves in a short amount of time. But, things still look ok for DIS. We should know relatively easy whether 109 will hold or not. What I mean by that, when slow movers have big runs, there’s not a ton of chopping around on support/resistance levels. Levels are more black and white and either hold or they don’t.

Think $TSLA, if you notice the levels are a little more grey and levels tend to get tested and retested. That doesn’t happen as much on blue chips and slow movers.

ETSY 0.00%↑

Trade Idea: 145c>140

There have been some wild intraday swings on this one. For example, Friday saw a low of 129 area while running back up to almost 140 by the close. I like the breakout area at 140 even though 142-142.50 lingers as a small resistance level. Even with only 2-2.5 points of stock movement, that should get 35-40% on the 145 call trade.

I would look to take profits at the 142.5ish area and then hang onto about 1/3-1/2 the position to see if it can pop over 142.5 for a run up to 145.

GME 0.00%↑

Rejection Trade Idea: 24 rejects on slowing momentum, take 22 puts.

Massive run on Friday. Broke thru the initial major resistance at 22 but now is coming up to the bottom of the big base that formed between September and December 2022. Once price gets up to the 24 area, I like this for a rejection/reversal type trade.

This trade will only work if price runs out of steam at 24. On Friday, it blasted thru 22 like it was nothing. The same thing could happen at 24. Make sure to size your position with a tight stop or, better in my mind, treat it like a lotto and be willing to let the trade go to zero if you’re wrong.

NFLX 0.00%↑

On Watch for support at 355.

Since their earnings report, Netflix has been on a nice run. However, on Thursday and Friday it started to show some relative weakness to the rest of big tech. It’s not the best movement when plenty of big tech/growth stocks are ripping and NFLX is linger red or flat.

For these reasons, NFLX is just on watch for tomorrow. I’m not willing to take a trade like this with Monday, in general, having the high premiums plus the weakness shown on last Thursday and Friday. If it was middle or end of the week, it would make more sense with less premium on the options.

RBLX 0.00%↑

Breakout Trade Idea: 40c>38

Roblox keeps coming up to 38 and rejecting. But, its also bouncing right back up after it pulls back. Remember, the more times a level gets tested, the weaker it gets. I like this as a breakout trade over 38.

It’s a pretty straight forward trade. If the market (or tech in general) is slow and choppy, this trade may not work. I like to see momentum stocks have the back drop of momentum in the broader markets. Even if that's the case, I still may try this trade with a small position. It’s a clean enough level to give it a try.

SHOP 0.00%↑

Trade Idea: 54c>51

This trade has proven really difficult for how simple the chart looks in hindsight. We have this massive daily base with clear cut levels, however, Shopify saw massive intra day moves while breaking out. Take a look at the massive candle from early last week.

It’s hard to take trades when we see 15%+ intra day moves with ugly candles. It would be one thing if it went straight up or straight down intraday, but we haven’t gotten that.

With all that, 51 is a pretty clear support/resistance area. You could take it early over 50 if you’re willing to take profits at the 51 level. Personally, I want to wait to see how price reacts at 51 early in the week. If price stays under 50 come Wednesday, I’d be more willing to enter early over 50 and go for a 1 point move with the possibility of a run.

TSLA 0.00%↑

Trade Idea: 200c>180 treat as a lotto or rollup

Tesla big time movement is back! Up, down, sideways…we always like it when there’s clean, big movement. 178-180 is the grey area of support/resistance. Since it’s a bit grey, I’ll wait for the round number of 180 to clear. Another option is to try and get in on a dip down to 177-178 and go long there. (Grey areas tend to both undershoot and overshoot levels).

Treat this trade as a lotto or rollup. The huge movement on Thursday, and specifically, Friday makes it hard to justify looking for another 100%+ trade. I’d be willing to take some profits off at 30-35%, then say 50%, and then leave some for runners. If the trade goes red, I’d either size it small enough to let it go to zero, or maybe have enough room to do one small add in a support area.

ZS 0.00%↑

Trade Idea: 135c>129

Zscaler broke out of the big falling wedge and hasn’t looked back. We did get a pull back last week, but price ran right back up and it formed a very positive candle while putting in a higher low. Price then continued to run up into the end of the week. 126 is strong support, so if a pullback does come, watch for that level to hold.

ZS options have relatively low liquidity and wide spreads. On these types of tickers, it is VERY important to send limit orders on both the buy side and sell side to protect yourself from getting screwed on a bad fill. It can make or break the trade by sending an appropriate priced limit order.

Also, I won’t alert this trade if I take it. Too many people jumping in at the same time will artificially move price. I like to give everyone an equal opportunity to get into the trade at a fair price.

Chart Requests:

LLY 0.00%↑

Not one that I typically trade due to it being a slow mover. Bigger picture the chart looks fairly negative with the big rounded top plus head and shoulders underneath. If you are looking at a swing trade, I would look to go long around 340 with tight stop. If it fails that will give more downside bias and I think 330-333 will come.

The long swing trade off 340 is the only thing I see for this one at this time. It needs some time for more trade setups to form up.

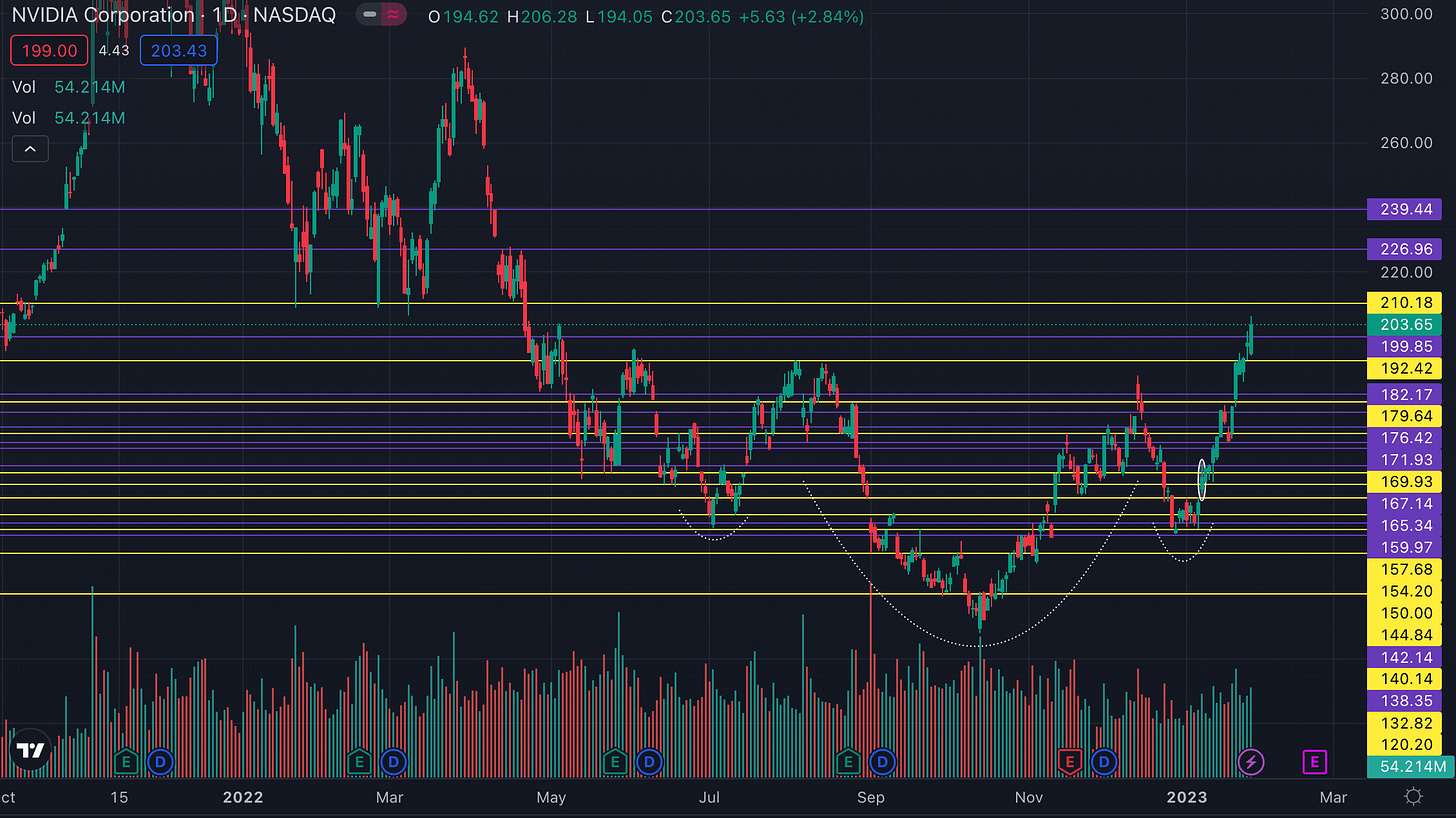

NVDA 0.00%↑

With AMD 0.00%↑ earnings coming up, the option's premiums for Nvidia are also elevated. I don't love taking a naked call or put trade. If you want to trade this, use a spread, fly, or common stock to avoid overpaying on the options.

I would look to go long on a 200 backtest assuming it holds and/or the broader market looks to be holding up. If we see a pop after AMD earnings, watch the 210 level. The premiums should come out a bit after the AMD report making a trade easier.